quitclaim deed colorado taxes

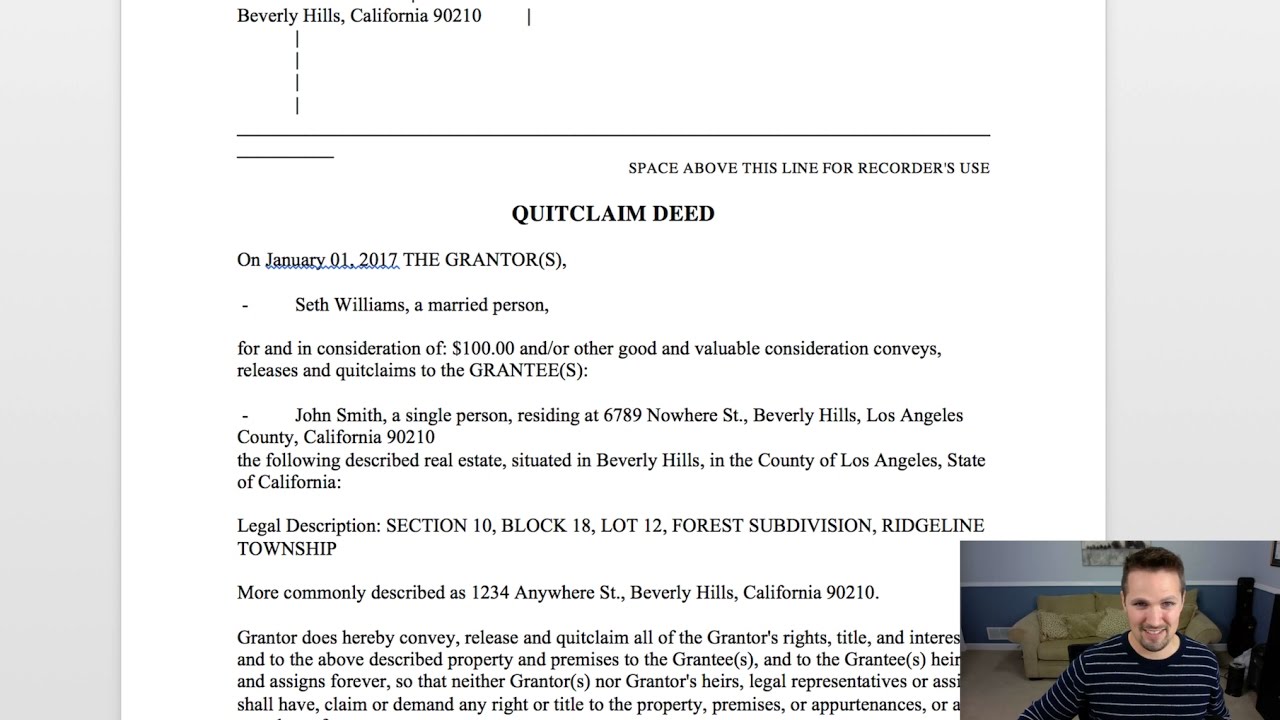

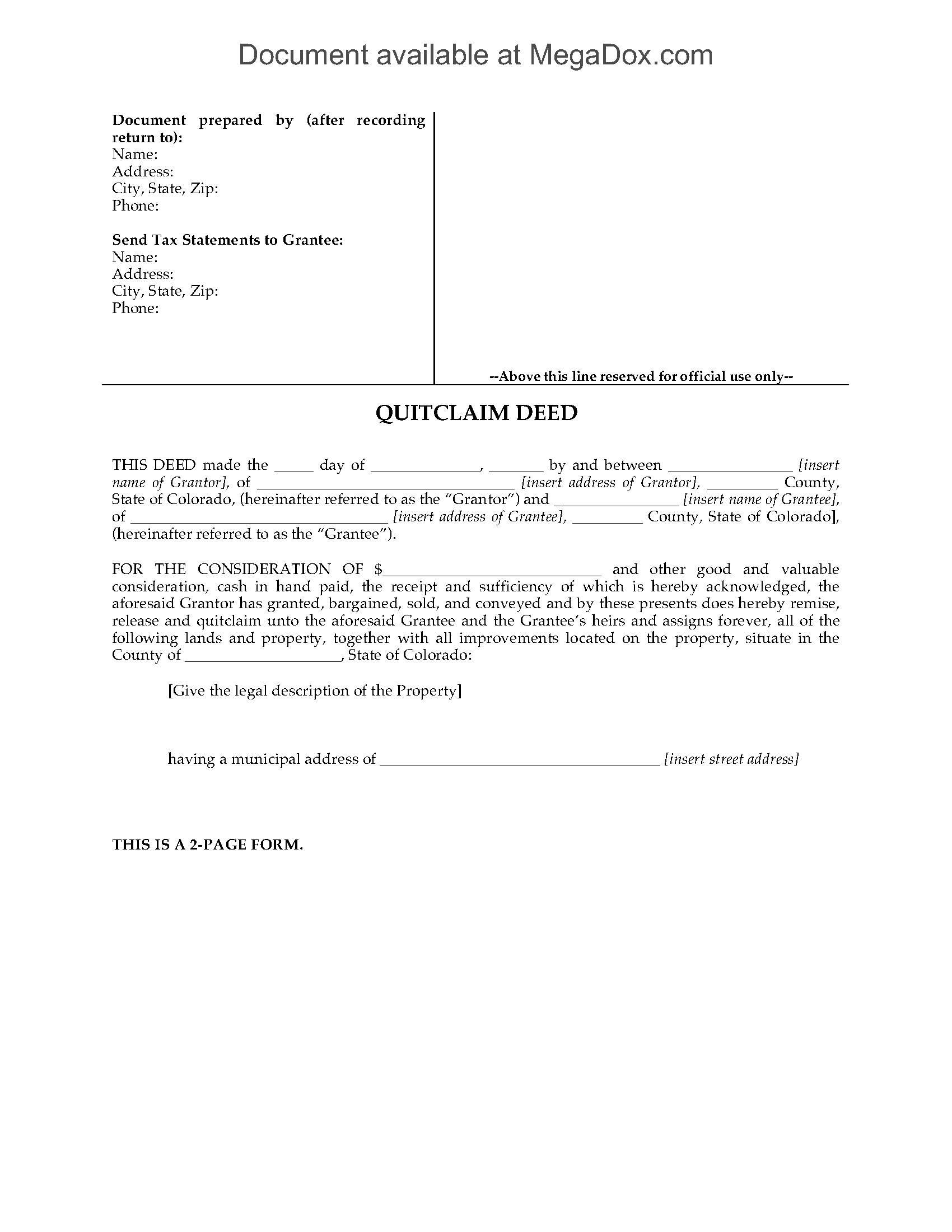

Statute Section 38-30-113 1 d Specific Language The word convey must not be allowed in the document and rather should be replaced with the word quitclaim. In some states owners have to pay their taxes within a few months or even years.

A Notary Certificate In 4 Simple Parts Notary Notary Public Business Notary Signing Agent

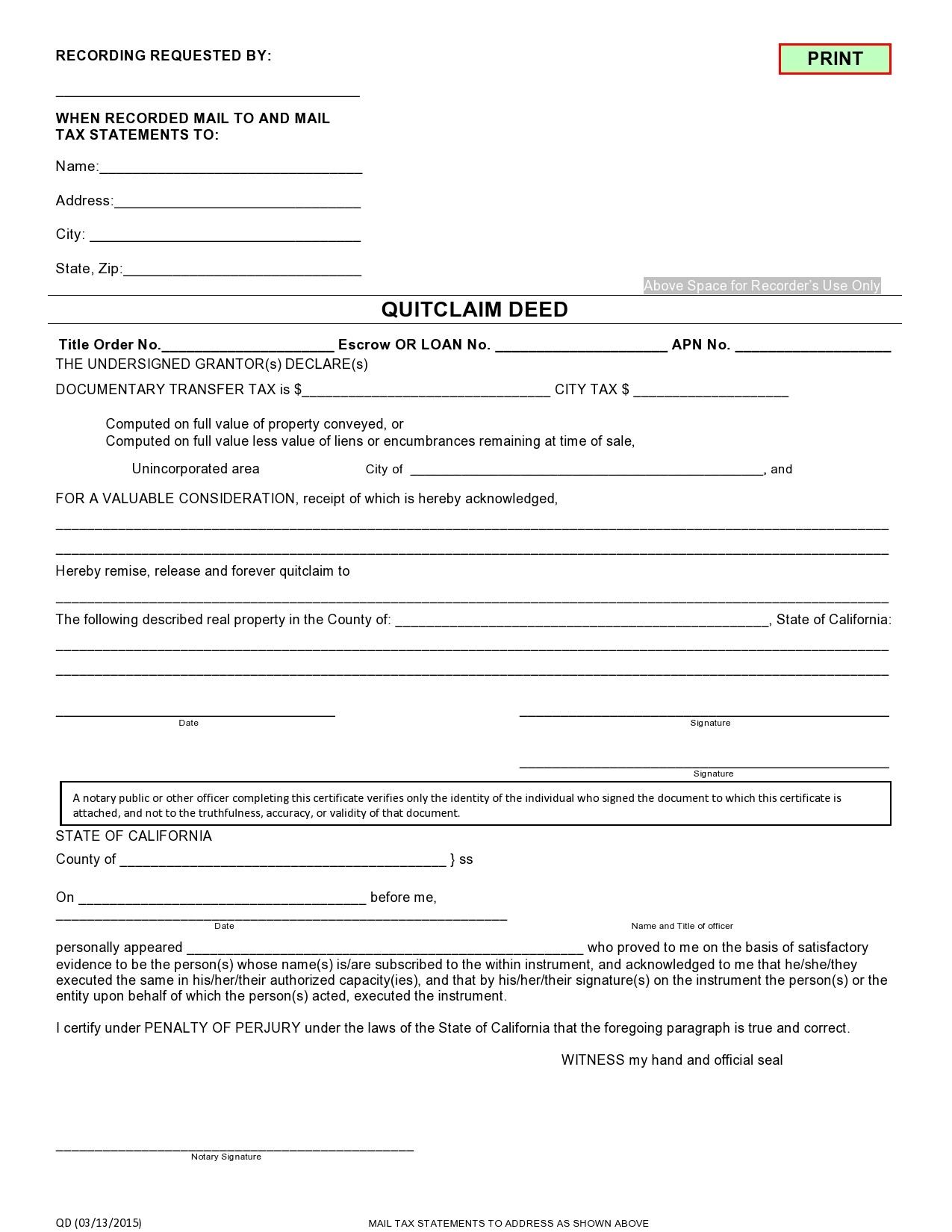

Signing 38-35-103 The quitclaim deed in Colorado must be acknowledged in front of a notary public.

. Taxes on real estate are collected all the time. File With Confidence Today. Quitclaim deed colorado taxes Wednesday March 16 2022 Edit.

A property owner may redeem or cancel the lien by paying the property tax liability along with the accrued interest and some costs. Create in 5-10 Minutes. If you quitclaim your property to your lender as part of a deed-in-lieu-of-foreclosure transaction you could be subject to two different types of tax.

As to the tax question the IRS will view the addition of the letter writer. Ad Answer Simple Questions About Your Life And We Do The Rest. The following items are needed to execute a Colorado quit claim deed.

Ad Legally Binding Quit Claim Deeds Colorado. For example A hereby quitclaims to B. Youll need the names of the grantor and grantee a legal description of the property which includes street address plot and subdivision the dollar value or purchase price of property also called consideration and the signatures of the grantor and notary public.

A colorado quitclaim deed form transfers whatever interest a property owner currently holds in real estate with no warranty of title. Most documents legal size or smaller are assessed a 13 recording fee for the first page and an additional 5 recording fee for each additional page. If the giver was gifted the home via a quitclaim deed and then executed a quitclaim deed to another person the person gifted the property would be on the hook for capital gains tax if he chose to sell the.

A gift to a new owner does not get a stepped up basis for income tax purposes. Create Legal Documents Using Our Clear Step-By-Step Process. 2 Save Print - 100 Free.

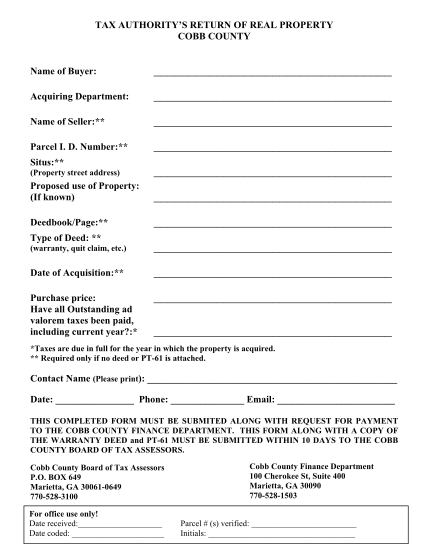

Transfer documents Warranty Deeds Quit Claim Deeds etc will be assessed a documentary tax if the consideration is 500 or more in addition to the recording fee. Ad 1 Create Quit Claim Deeds With Our Easy Builder. Plats are assessed a recording fee of 13.

A tax deed is an agreement to tax a particular type of business. A Colorado Quitclaim Deed quit claim deed is a type of deed used to transfer ownership or to quit or end someones claims of real estate ownership. For example a home purchased 20 years ago for 10000000 and now worth 40000000 will have a new income tax basis of 40000000 on the day the owner dies.

If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax. Under the terms of the US. Ad Quitclaim Deed More Fillable Forms Register and Subscribe Now.

Create Legal Documents Using Our Clear Step-By-Step Process. Instead a quit claim deed Colorado only quits gives up any interest in the property that the grantor might have had. There is also a yearly exemption of 15000.

The excluded amount is taken off the taxpayers total allowable lifetime exclusion. An asset owner whose true income is not reflected in their tax return is entitled to a tax lien. The documentary tax is.

If we sell property we acquired through a quitclaim deed how do we address the proceeds on our taxes. And QUITCLAIMED and by these presents does remise release sell and QUITCLAIM unto the Grantee and the Grantees heirs and assigns forever as _____ all of the right title interest claim and demand that the Grantor has in and to the real property together with the fixtures and. Tax code gift taxes are paid by the giver so the brother would have to fill out a gift tax form 709 and he can apply the value of half the house to the lifetime maximum of 55 million he can give away under current estate tax rules.

It makes no guarantee that the title is clear and if the person does own the property and any problems exist with. At death all property of the deceased is revalued for income tax purposes. Transfer Property Interest from One Person to Another.

This type of transfer comes with no warranty meaning it comes with no guarantees that the title is free and clear of any encumbrances or back taxes. Manage docs easily while keeping your data safe with quit claim deed colorado taxes online. Transfer documents Warranty Deeds Quit Claim Deeds etc will be assessed a documentary tax if the consideration is 500 or more in addition to the recording fee.

In Colorado a quitclaim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion. Connecticut Grant Deed Form Download Printable Pdf Templateroller Ad Answer Simple Questions To Make Your Quit Claim Deed. The current US exemption from estate tax is 11400000.

Colorado Quitclaim Deed. As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift. If you quitclaim half of your duplex 300000 that is a gift worth 150000You will need to file a gift tax return listing the gift but you will not need to pay tax on the gift.

My wifes father named her and her sister along with himself on the quitclaim deed as joint tenants with rights of of survivorship. If the giver inherited the home and then executed the quitclaim deed to another person the person gifted the property could sell without paying capital gains tax. Ad Answer Simple Questions To Make Your Quit Claim Deed.

Essentially a quitclaim deed only guarantees that a seller cannot come. The grantee is the party receiving the interest. A quitclaim deed or non-warranty deed should be used with caution.

The grantor is the party transferring their present interest in the property if any. These tax liens can be attractive investments because the interest rates are generally in the double digits tax lien rates are set annually at nine points above the federal discount rate. TurboTax Makes It Easy To Get Your Taxes Done Right.

41 Free Quit Claim Deed Forms Templates ᐅ Templatelab

How Much Is 3 Quarters Of A Million Dollars Scramble Words Dollar School Programs

The Mega Profit Potential Of Apartment Syndication Double Your Money Retirement Planner Retirement Best Places To Retire

126 Quitclaim Deed Form Page 8 Free To Edit Download Print Cocodoc

Laurent Carrier On Dailymotion Retirement Planner Planner Carriers

How To Create A Quit Claim Deed Youtube

How To Fill Out A Quitclaim Deed 12 Steps With Pictures

Colorado Quitclaim Deed Legal Forms And Business Templates Megadox Com

Laurent Carrier Financial Colorado Springs Estate Planning Money Management How To Plan

I Signed Over My House To My Daughter How Do I Reverse That The Washington Post

Should I Sign A Quitclaim Deed During Or After Divorce

76 Example Of A Quit Claim Deed Completed Page 5 Free To Edit Download Print Cocodoc

41 Free Quit Claim Deed Forms Templates ᐅ Templatelab

Homeowners Don T Fall For Fake Promises Of Lower Property Taxes Irs Taxes Tax Deductions Tax Questions

Quitclaim Deed What Are The Tax Implications Money

Laurent Carrier Colorado Springs On Youtube House Movers First Time Colorado Springs

Quick Claim Form 12 Facts You Never Knew About Quick Claim Form Quitclaim Deed Doctors Note Template Letter Templates Free