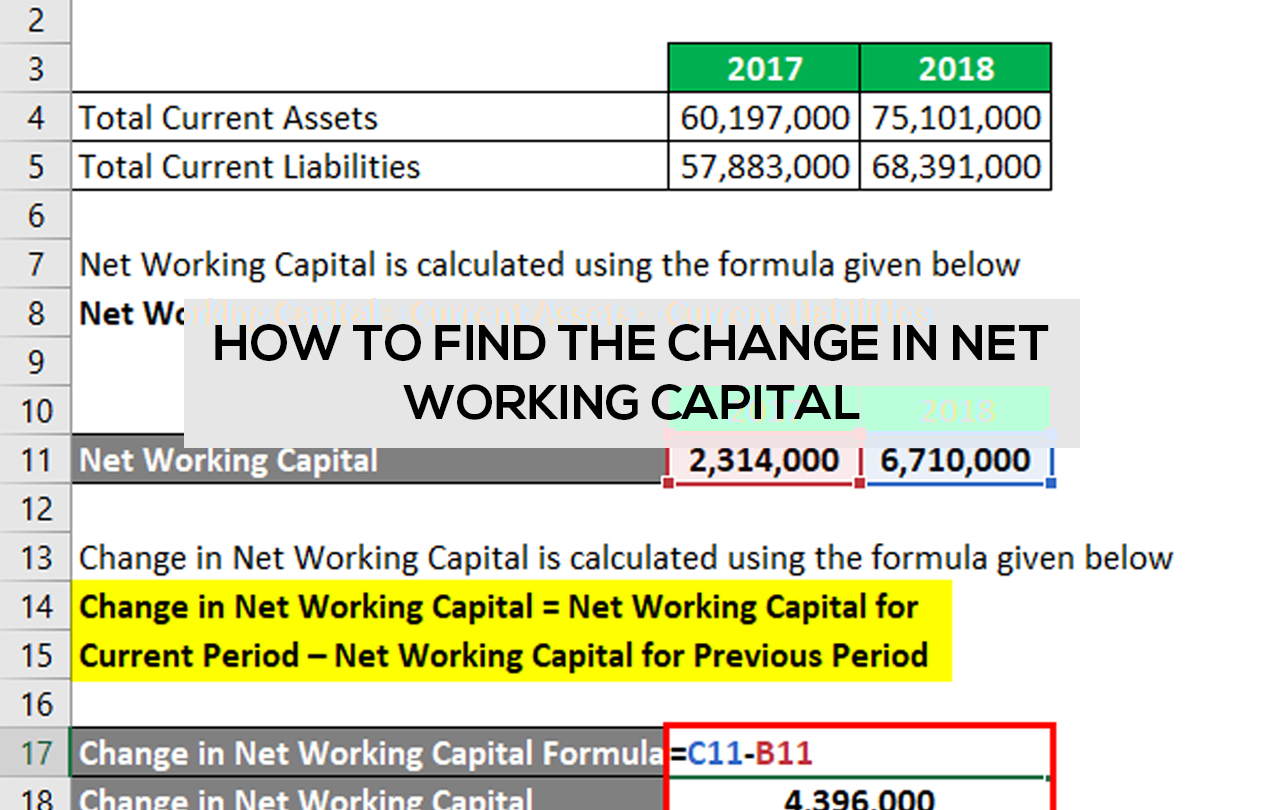

change in net working capital formula

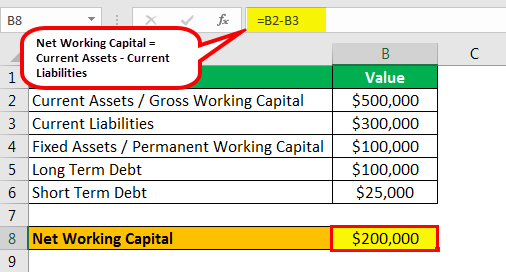

For year 2020 the net working capital is 10000 20000 Less 10000. Total current liabilities Sundry Creditors Outstanding advertisements 45000 5000 50000.

Net Working Capital Formula Calculator Excel Template

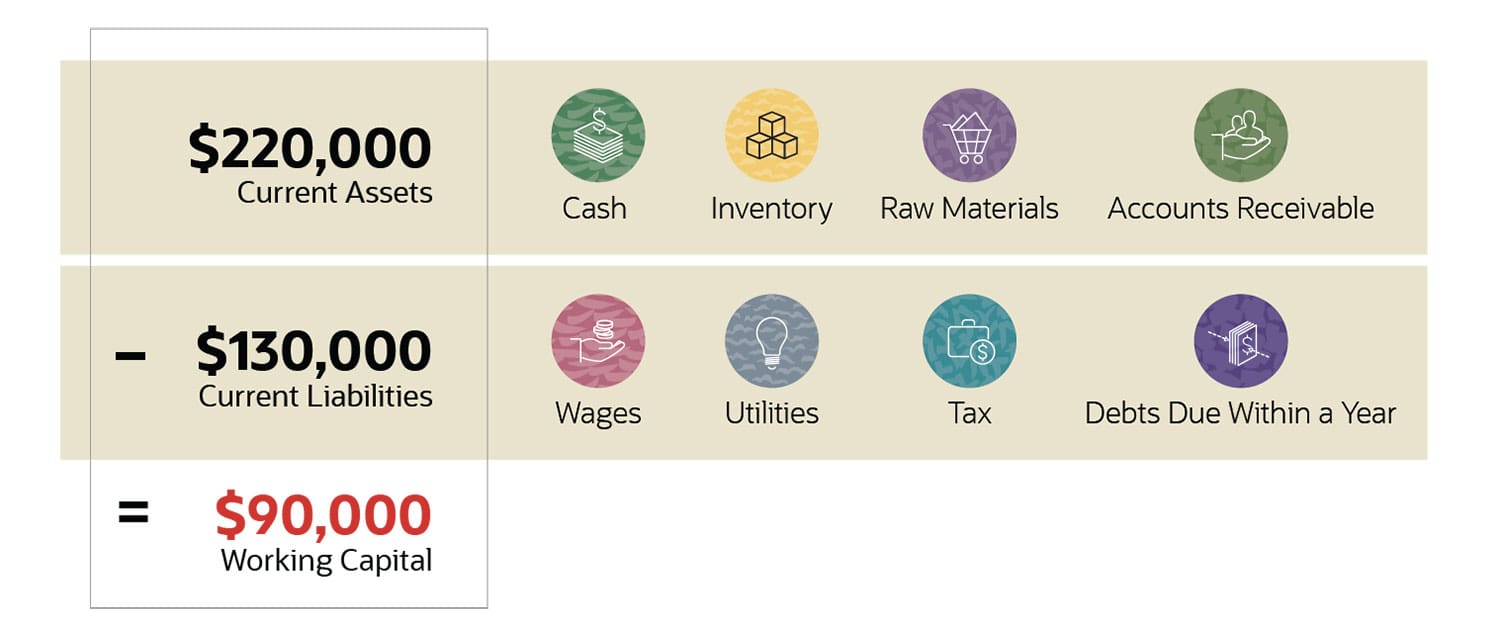

That difference is your working capital WC.

. How To Calculate Change in Net Working Capital. To illustrate how much of a change each of these assumptions can have on working capital requirements Table 1011 forecasts expected changes in non-cash working capital using each. You can find the net working ratio with this simple calculation.

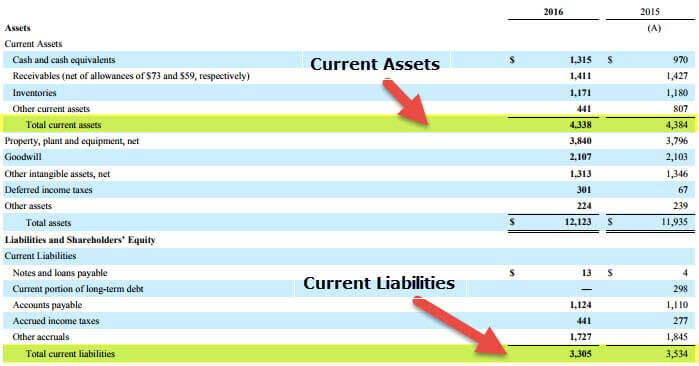

Here you can see. Then we will do the same for the liabilities. The Net Working Capital Formula is Total Current Assets Total Current Assets.

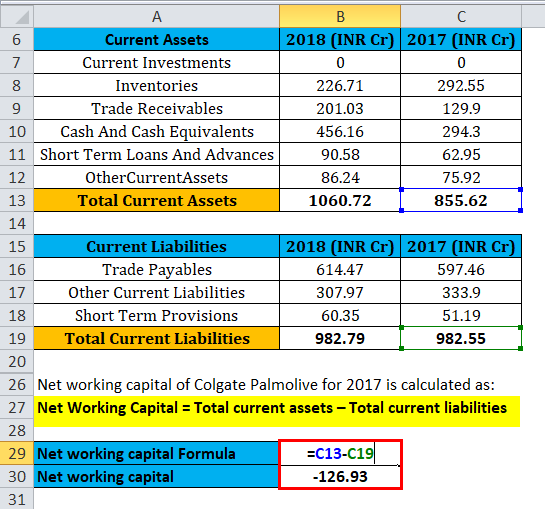

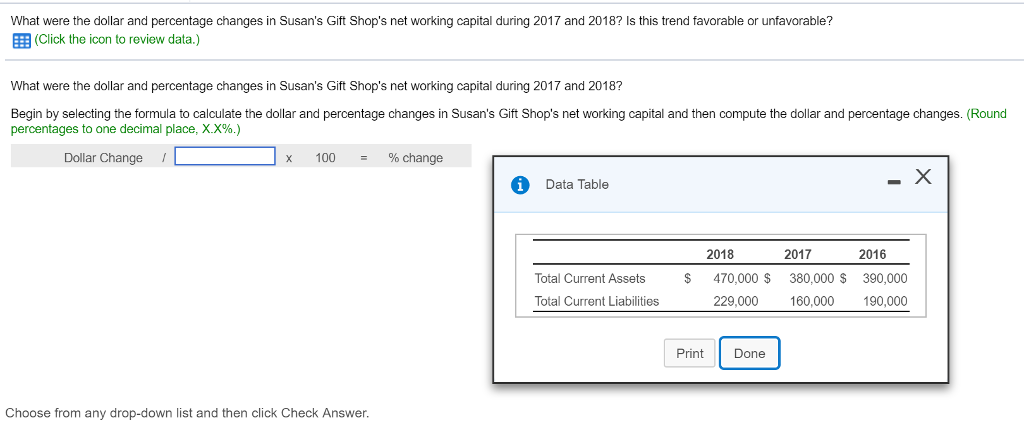

To calculate our change in working capital we will take all the items from the assets and add them together. The net working capital ratio measures the proportion of a businesss short-term net cash to its assets. Changes in the Net Working Capital Net Working Capital of the Current Year Net Working Capital of the Previous Year.

Therefore it is important for you to determine the optimal level of working capital. It deals with the current assets. Thus if net working capital at the end of February is 150000 and it is.

Calculate total current liabilities for current and previous. Changes in the Net Working Capital Formula. For the year 2019 the net working capital was 7000 15000 Less 8000.

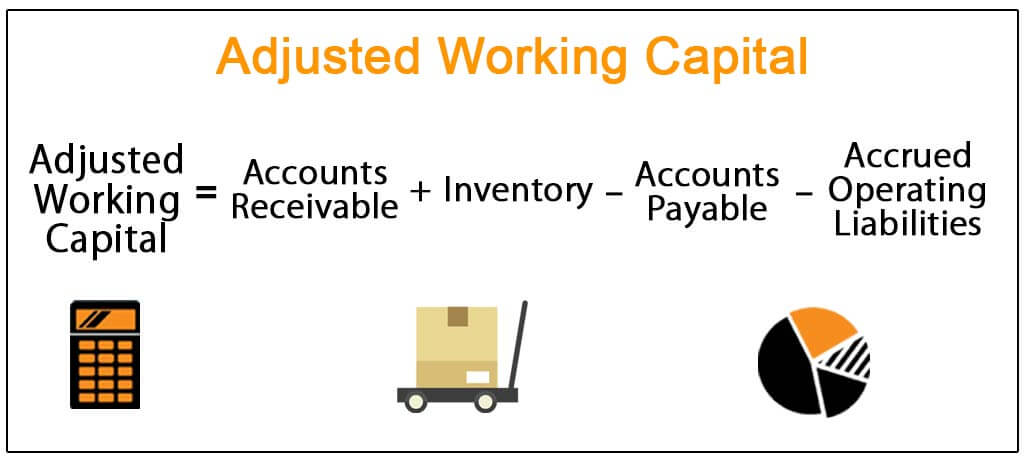

Change in Net Working Capital NWC Calculation Example Accounts Receivable AR 50mm Inventory 25mm Accounts Payable 40mm Accrued Expenses 20mm. Thus the value of working capital in 2021 comes out to be -9972000000. The formula for working capital is current operating assets minus current operating liabilities.

It also forecasts what will be the growth of business in the future. Next compare the firms working capital in the current period and subtract the working capital amount from the previous period. Now changes in net.

Changes in working capital are an. Cash Flow is the net amount of cash and cash-equivalents being transferred in and out of a company. Non-cash working capital is the Financial term that indicates a business is profitable or not.

There would be no change in working capital but operating cash flow would decrease by 3 billion. Positive cash flow indicates that a companys liquid. For instance if a company has current assets of 100000 and current liabilities of.

Non-cash working capital receivables inventory payables Non-cash working capital 10000 200000 25000 30000 Non-cash working capital 155000. Calculate total current assets for current and previous years.

Working Capital What It Is And How To Calculate It Efficy

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital Examples Top 4 Examples With Analysis

Change In Working Capital Video Tutorial W Excel Download

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Use How To Calculate Interpret It Formula Getmoneyrich

A Complete Guide To Net Working Capital And How To Calculate It

Changes In Net Working Capital Step By Step Calculation

Net Working Capital Template Download Free Excel Template

Change In Net Working Capital Formula Calculator Excel Template

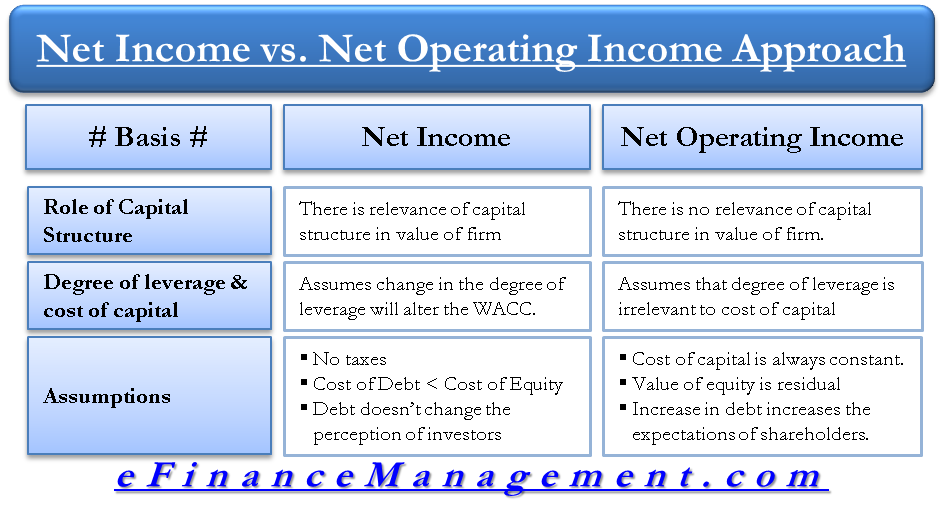

Difference Between Net Income Vs Net Operating Income Approach

Net Working Capital Formula Calculator Excel Template

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

Net Working Capital Definition Formula How To Calculate

Chapter 11 Cash Flow Estimation Ppt Video Online Download

Solved What Were The Dollar And Percentage Changes In Chegg Com

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

Statement Of Changes In Working Capital Definition Formula Examples

/WORKING-CAPITAL-FINAL-SR-16dac45bb5fb4f0cad62cd706c59e0cd.jpg)